When you pick up a prescription at the pharmacy, you rarely think about what happened before it got there. Who made it? How did it get from a factory in India or China to your local drugstore? And most importantly-why does a $5 generic pill sometimes cost $40 at the counter? The answer lies in wholesale economics, a hidden layer of the drug system that controls how generic medications move and how much they cost.

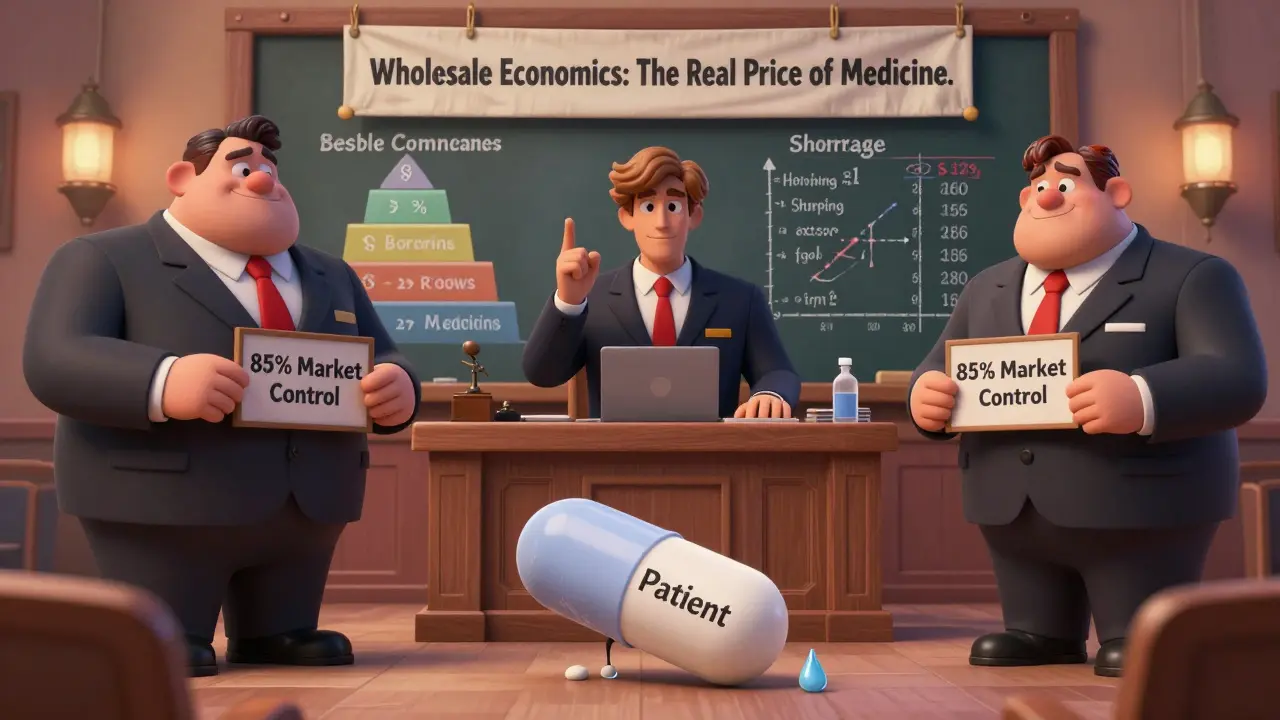

Most people assume drug prices are set by manufacturers or pharmacies. But the real power sits with a handful of wholesale distributors. In the U.S., three companies-AmerisourceBergen, Cardinal Health, and McKesson-control about 85% of the entire generic drug distribution network. They don’t make the pills. They don’t sell them directly to patients. Yet they make more money from generics than anyone else.

How Generic Drugs Move Through the System

The path of a generic drug is simple in theory: manufacturer → wholesaler → pharmacy → patient. But the economics behind it are anything but simple.

Manufacturers produce the drug, often at very low cost. A generic version of a common antibiotic might cost $0.10 to make. But by the time it reaches your pharmacy, the price has jumped. Why? Because every stop along the way needs to make money. And here’s the twist: wholesalers make more profit per dollar spent on generics than manufacturers do on branded drugs.

According to research from the USC Schaeffer Center, wholesalers earn about eleven times more profit on generic drugs than on brand-name drugs. For every $100 spent on generics, wholesalers pocket around $32 in gross profit. For brand-name drugs, that number is just $3. That’s not a typo. It’s the opposite of what you’d expect.

This happens because brand-name drug makers hold patents and can set high prices. Wholesalers have little room to negotiate. But with generics? Thousands of companies make the same drug. Competition is fierce. So manufacturers slash prices to win contracts. Wholesalers, sitting in the middle with massive buying power, demand deeper discounts-and then mark up the price just enough to keep pharmacies buying.

The Profit Puzzle: Who Gets What?

Let’s break down the numbers. In 2009, generics made up only 9% of total wholesale revenue. Yet they generated 56% of the gross profits for the Big Three wholesalers. That’s because their margins are razor-thin on volume-but massive on volume.

Here’s how the profit breaks down:

- Manufacturers: Gross margin of 49.8% on generics vs. 76.3% on branded drugs.

- Wholesalers: Net margin of just 0.5%-but gross profit per dollar spent is 11x higher on generics.

- Pharmacies: Gross margin of 42.7% on generics-almost 12x higher than on branded drugs.

Think of it like this: Manufacturers sell generics for pennies. Wholesalers buy in bulk at rock-bottom prices, then sell them to pharmacies at a small markup. Pharmacies then sell them to you at a higher markup. But because generics are so cheap to produce, even a tiny increase in price means huge profit.

For example, a generic pill that costs $0.20 to make might be sold to a wholesaler for $0.50. The wholesaler sells it to a pharmacy for $0.75. The pharmacy sells it to you for $2.00. The manufacturer made $0.30. The wholesaler made $0.25. The pharmacy made $1.25. But the manufacturer had to produce millions of pills to make that $0.30. The pharmacy made $1.25 on one pill.

How Pricing Is Set: The Four Strategies

Wholesalers don’t guess at prices. They use four clear strategies:

- Cost-plus pricing: Add a fixed percentage to the cost of making and shipping the drug. Simple. Predictable. But ignores competition.

- Market-based pricing: Look at what competitors charge. If your rival sells a drug for $1.20, you match it. Keeps you in the game but kills margins.

- Value-based pricing: Charge more if the drug is hard to find, used in emergencies, or has no substitutes. This is where shortages become profitable.

- Tiered pricing: The most common method. The more you buy, the cheaper it gets. For example: $10 per unit for orders under 100 units, $8 for 100-500, $6 for over 500.

Shipping costs matter too. If a drug costs $10 to produce and $2 to ship, the wholesaler won’t sell it for $10. They’ll charge $12 or more to cover everything. Many small pharmacies don’t realize this-until they get a bill.

Why Generic Drug Shortages Change Everything

In 2020, during the pandemic, drug prices spiked. Supply chains broke. Factories shut down. Wholesalers scrambled. Then, in 2021 and 2022, prices fell hard. The market was flooded. Everyone was cutting prices to survive.

But in 2023, everything flipped. Generic drug shortages returned. Not because of demand. But because manufacturers stopped making certain drugs. Why? Because the price they could get from wholesalers was too low to cover production costs.

When a drug becomes scarce, wholesalers raise prices. Not because they’re greedy. Because they have no choice. Pharmacies still need the drug. Patients still need it. So wholesalers jack up the price-and pharmacies pass it on. A drug that cost $1.50 last year might now cost $8. That’s inflation, driven by supply, not demand.

The Commonwealth Fund found that wholesalers have outsized influence over these shortages. They decide which manufacturers get contracts. They can drop a supplier overnight. And when a drug vanishes, they’re the ones who set the new price.

The Hidden Power of the Big Three

AmerisourceBergen, Cardinal Health, and McKesson aren’t just big. They’re monopolistic. With 85% of the market, they can dictate terms. A small manufacturer trying to sell a new generic? They have to accept whatever price the wholesalers offer. No negotiation. No alternatives.

This system works because it’s efficient. But it’s also rigged. The more consolidation there is, the less competition there is. And less competition means higher prices for patients.

Here’s a brutal truth: Wholesalers don’t need high revenue to make high profits. They make money by moving huge volumes at tiny margins. A single generic drug might earn them 20 cents per pill. But if they move 10 million pills a month? That’s $2 million in profit. And they do this for hundreds of drugs.

What’s Next? The Future of Generic Distribution

The system isn’t broken. It’s working exactly as designed. But it’s designed to benefit wholesalers, not patients.

Some experts say we need more competition. Let smaller distributors enter the market. Let pharmacies buy directly from manufacturers. Let online platforms cut out the middleman.

Others argue for regulation. Force wholesalers to disclose pricing. Cap markups. Require transparency in how shortages are managed.

One thing is clear: the current model rewards volume over value. It punishes innovation. And it lets a handful of companies profit from the very drugs that keep people alive.

As more generics enter the market-and as shortages become more common-the pressure will grow. Patients will start asking why a $0.05 pill costs $10. Pharmacists will push back. And eventually, the system will have to change.

Until then, the wholesalers keep moving pills. And making more money than anyone else.

Why do wholesalers make more profit on generic drugs than manufacturers?

Manufacturers face fierce competition because thousands of companies can make the same generic drug. To win contracts, they slash prices. Wholesalers, with massive buying power and few competitors, demand deep discounts and then mark up prices just enough to keep pharmacies buying. This gives them outsized gross profit margins-11 times higher than on brand-name drugs-even though the revenue from generics is smaller.

How do tiered pricing structures work in generic drug distribution?

Tiered pricing means the more you buy, the cheaper each unit gets. For example, a wholesaler might charge $10 per unit for orders under 100 units, $8 for 100-500 units, and $6 for over 500 units. This encourages pharmacies and hospitals to order in bulk, which keeps inventory moving and locks in long-term business. It also helps wholesalers reduce per-unit shipping and handling costs.

Why do generic drug shortages cause price spikes?

When a generic drug becomes scarce, pharmacies still need it. Patients still need it. Wholesalers, who control most of the supply, raise prices because they know buyers have no alternatives. This turns a low-margin product into a high-margin one. A drug that once cost $1 might jump to $8 because there’s only one supplier left-and they can charge whatever they want.

Do shipping costs affect wholesale pricing?

Yes. Many people forget that the cost of shipping is baked into the wholesale price. If a drug costs $10 to produce and $2 to ship, the wholesaler won’t sell it for $10. They’ll charge at least $12 to cover costs and still make a profit. In rural areas or during supply chain delays, shipping can add 10-20% to the final price.

Can pharmacies buy directly from manufacturers to avoid wholesalers?

Technically, yes-but it’s rare. Most manufacturers require minimum order volumes that only big hospital systems can meet. Smaller pharmacies don’t have the storage space, cash flow, or logistics to handle direct orders. Wholesalers act as middlemen who aggregate demand from hundreds of pharmacies, making it easier and cheaper for everyone to get drugs.

Tom Forwood

February 9, 2026 AT 15:30Andy Cortez

February 11, 2026 AT 00:30Patrick Jarillon

February 12, 2026 AT 23:26Kathryn Lenn

February 13, 2026 AT 23:21MANI V

February 14, 2026 AT 19:13Joshua Smith

February 16, 2026 AT 11:33Chima Ifeanyi

February 17, 2026 AT 19:50John Watts

February 18, 2026 AT 13:30